Robinhood tax calculation

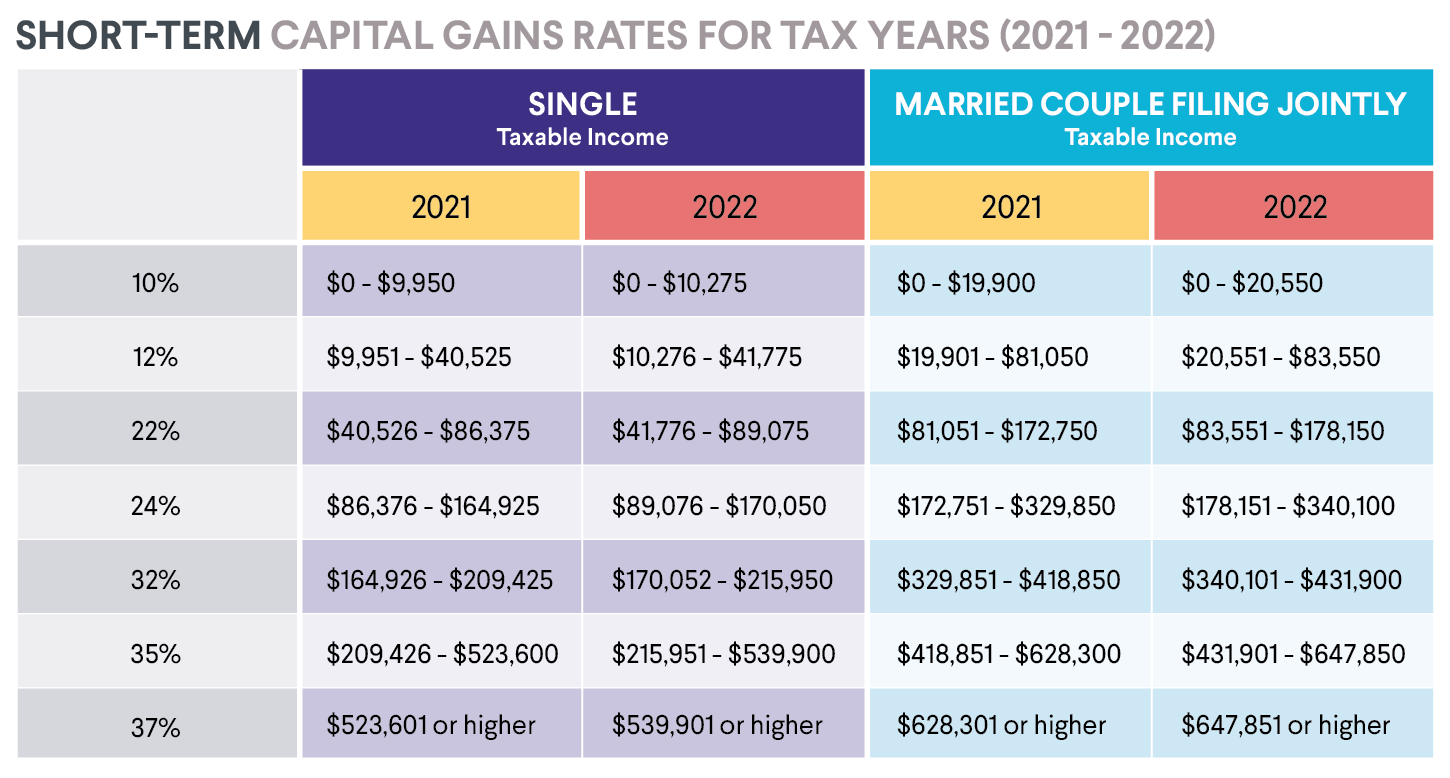

Web Stocks held less than one year are subject to the short term capital gains tax rate which is the same tax rate you pay on your ordinary income. Remember capital losses may help offset capital gains.

Etf Vs Mutual Fund Which Is Better For You Finpins Mutuals Funds Mutual Investing Apps

The average sales tax in the state combining state and average local.

. Web About tax documents How to access your tax documents How to read your 1099 How to correct errors on your 1099 How to upload your 1099 to TurboTax Finding your account. Stocks held longer than. Web The tax will now range from 0 to 20 depending on the investors annual income.

Web Koinly is a Robinhood crypto tax reporting tool. Web This article will give you the tax advice to file your Robinhood 1099 forms and pay as little as possible using 1099 tax deductions while satisfying the IRS. Capital gains and losses are categorized.

Web If you had 5000 of capital gains and 3000 of capital losses you would now have just 2000 of capital gains to pay taxes on. Effortlessly calculate your Robinhood crypto taxes and generate the right tax reports to send to your tax authority. Though you can file your Robinhood taxes separately using your Consolidated 1099-B if youre using any other.

Web Minus Tax Amount 000. Web Where is Robinhood Forest VA in United States. The California State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated.

If you are an employee you can apply for help to decide whether you need to give your employer a new form W-4Checking your withholding can help protect. Map with the location of Robinhood Forest Virginia tables with distances from nearby centers and major cities. Web Gross income and taxable income often go hand in hand but there are important differences.

Web How to Connect Robinhood Crypto and Koinly. What is Robinhood Taxes. State taxes may vary.

Gross income is the sum of all income you earn in a given tax year. Web It will be your job to report this data on your tax return once youve received your Robinhood markets tax forms. Web Virginia has a progressive income tax with a top marginal rate that is slightly lower than the national average.

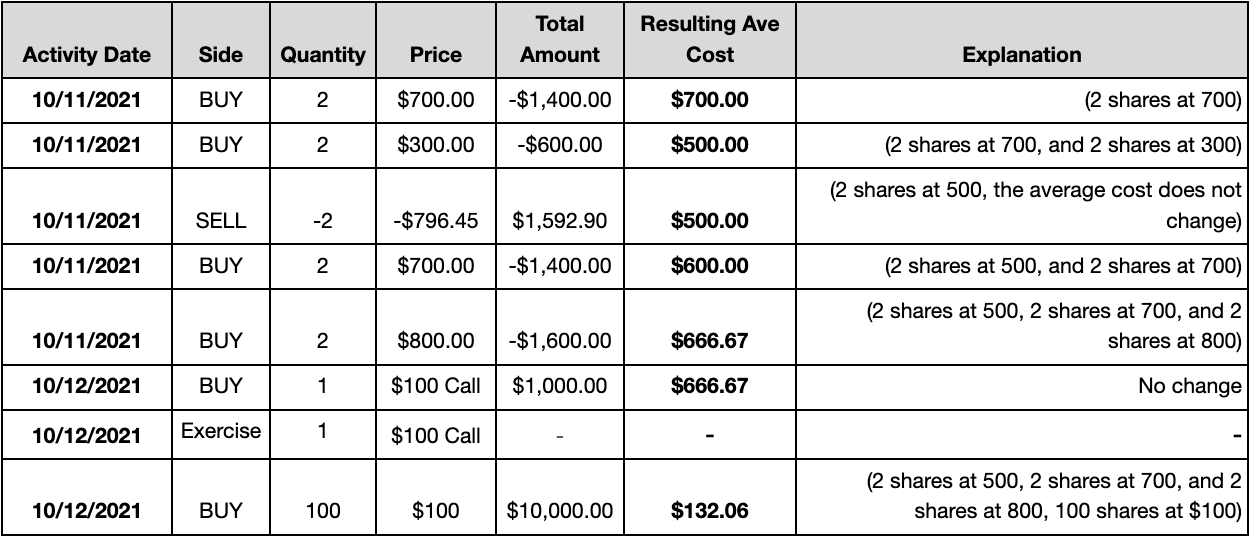

Sum of all the money received from selling the shares - Sum of all the money spent on the trades EXCLUDING the ones you.

What Is A Tax Deduction Robinhood

1

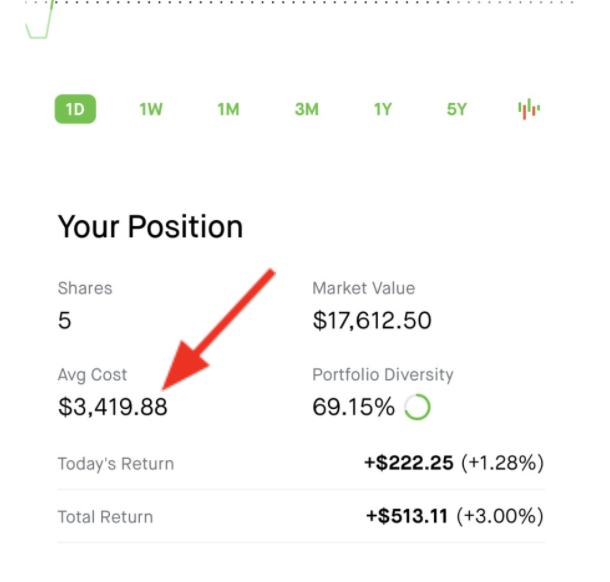

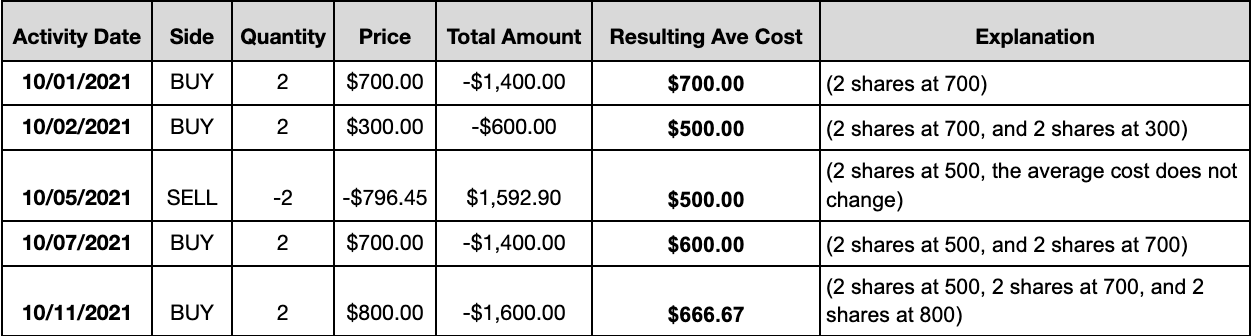

Average Cost Robinhood

6 Small Business Lessons For 2021 Constant Contact Small Business Organization Marketing Strategy Social Media Small Business Tips

How To Read Your 1099 Robinhood

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Investing Stock Market

Crypto Tax And Accounting Software Libra Raises 15m In Series B Funding Planejamento De Negocios Negocios Cometer Erros

Average Cost Robinhood

What To Know About Paying Taxes On Stocks Sofi

Minimizing Capital Gains When Selling Stock In Your Robinhood Account

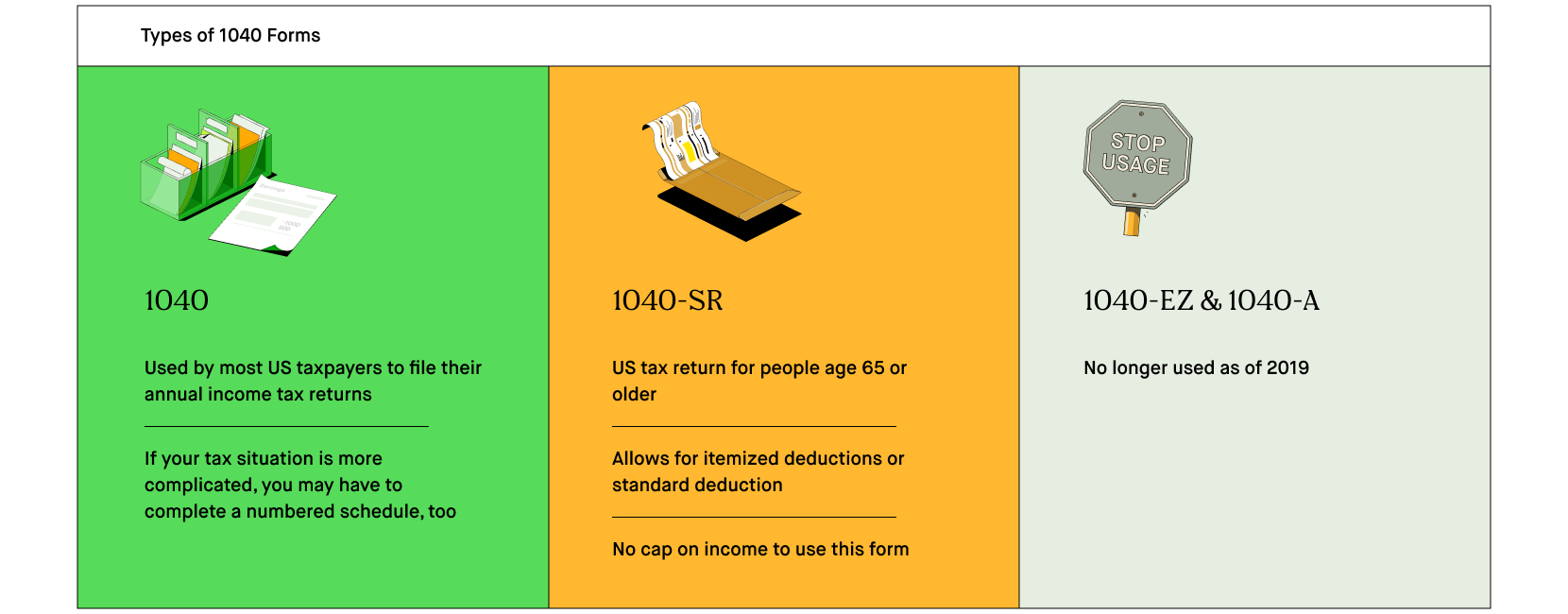

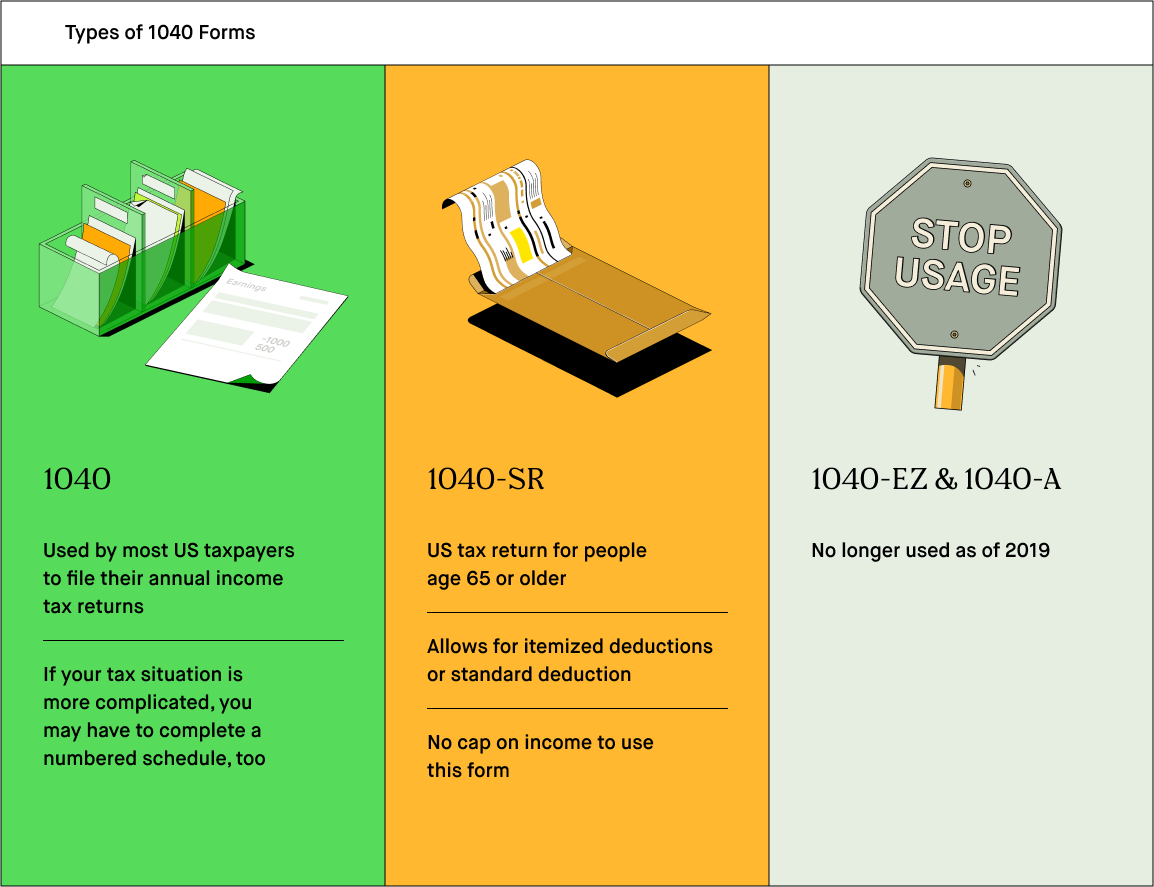

What Is Form 1040 Robinhood

1

Average Cost Robinhood

1

Robinhood Tax Documents Tax Reporting Explained Zenledger

How To File Robinhood 1099 Taxes

Robinhood